Container lines face growing pressure to suspend low sulphur surcharges and drastically cut other fuel charges levied on shippers as the crash in oil prices dramatically reduces the cost of bunker fuels.

Lines pass on the cost of fuel to customers via Bunker Adjustment Factor (BAF) fees and various Low Sulphur Surcharges (LSS) using complex methodologies which typically means there is a lengthy lag between changes in the fuel price being reflected in revised surcharges for customers.

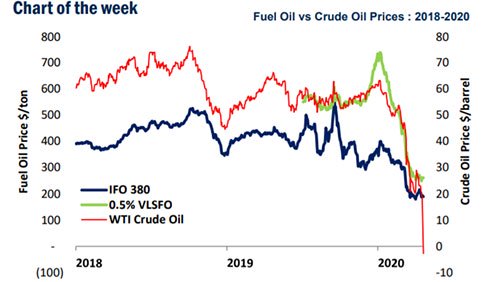

Shippers and forwarders claim that current BAFs are far too high and should be cut to reflect the rapid drop in bunker prices (see Alphaliner chart below).

They also believe low sulphur surcharges should be removed given that the price differentials between Very Low Sulphur Fuel Oil (VLSFO) and standard IFO380 are now so narrow.

They also believe low sulphur surcharges should be removed given that the price differentials between Very Low Sulphur Fuel Oil (VLSFO) and standard IFO380 are now so narrow.

“We’re being asked to pay bunker surcharges at pre-crude crash prices and, on top of that, we’re being charged for the use of low sulphur fuels when the price of these fuels is now more or less the same as heavy fuel oil,” said one shipper source.

“Low sulphur surcharges are now obsolete.”

Cape of Black Smoke?

A UK-based forwarder said it was “a bit rich” for lines to charge environmental surcharges for the use of low sulphur fuels when they were now taking advantage of low bunker prices by routing vessels from Asia to Europe via the Cape of Good Hope to avoid paying Suez Canal fees.

“They’re burning fuel in the least sustainable way and charging us environmental fees to pay for it,” he told Lloyd’s Loading List.

Ahead of the introduction of International Maritime Organization (IMO) rules on January 1 which made it mandatory for ships to use low sulphur fuels unless fitted with emission abatement technology such as scrubbers, shippers feared that lines would use low sulphur fuel surcharges to bolster profits. The recent slump in oil and bunker prices has done nothing to assuage those fears.

The sulphur price spread

Certainly, the price differential between low sulphur and heavy fuel oil is becoming increasingly marginal with some regional indexes now reporting that the price of VSLFO has fallen below the cost of Heavy Fuel Oil.

According to Ship&Bunker, the average bunker price at the global top 20 ports is currently $225 per tonne for VLSFO and $164.50 per tonne for IFO 380. In the Americas, the differential is even narrower with average VLSFO now priced at $309 versus $288 per tonne for IFO 380.

CMA CGM leads the way on LSS

Thus far, CMA CGM is the only leading line to commit to suspending its low sulphur surcharge.

The French carrier announced earlier this month that “taking into consideration the current price of VLSFO” it would not levy a Low Sulphur Surcharge (LSS20) on any trades with the exception of intra-Asia from 1 May until further notice.

One liner source told Lloyd’s Loading List that carriers would eventually be forced to follow CMA CGM’s lead. “If they don’t they will lose their credibility when the spread (between VLSFO and heavy fuel oil) comes back,” he said. “They simply have to.

“They won’t scrap them after fighting for so long for them. But they’ll suspend them.”

Bunker charges multiply

The UK-based forwarder said he simply wanted “some fairness and transparency” from carriers.

One Asia based forwarder executive illustrated what he called “exorbitant carrier fuel pricing” by outlining some of the bunker-related fees he is currently being charged by one of the world’s leading carriers.

For a shipment from Asia to the US East Coast, the line is currently charging him an LSS of $100 per 40 ft high-cube container based on its calculation of a 13-week average Marine Gas Oil (MGO) fuel price covering December through February of $610.82. The current price of MGO according to Ship&Bunker’s ‘Global 4 Ports Average’ is $253.50.

The same line is also levying a bunker charge of $955 per 40 ft high-cube box shipped to the US East Coast and, from the start of May, an IMO SOx Compliance Charge (ISOCC) of $297.

Out of the leading European lines contacted by Lloyd’s Loading List about their LSS plans, MSC did not reply to enquiries.

A spokesman for Maersk said the carrier had no plans to diverge from the BAF and LSS [Maersk calls this an Environmental Fuel Fee] regimes already announced which he said gave customers “predictability” and would be adjusted to reflect lower bunker prices from 1 May.

A spokesman for Hapag Lloyd, which uses a Marine Fuel Recovery (MFR) bunker regime, said the LSFO 0.5 price was currently around $200 per tonne.

“We have adjusted our MFR recently as of 1 April 2020 and there are no plans to cancel the MFR as we are still paying this money for fuel,” he added. “The next quarterly adjustment is planned for 1 July 2020.”

The liner lag on fuel

The liner source said carriers were justified in not passing on lower fuel costs immediately.

“There is an argument for a lag because for low sulphur fuels, the lines were already buying this at very expensive prices back in November to be ready,” he said.

“No one was paying that additional cost until January. So they are justified in a lag for at least a month. But too long beyond that, it will be difficult to justify.”

Lars Jensen, CEO of SeaIntelligence Consulting, told Lloyd’s Loading List that shippers had no reason to assume they were unfairly losing out on liner fuel surcharges following the collapse of oil prices.

“It would be true that right now [shippers] will be paying a BAF based on an oil price that is much higher than the current reality, but to complain that this is a profit centre is simply a misunderstanding of the BAF mechanism in general,” he added.

“A BAF will always have a time lag. In order to change the BAF you have to know what the oil price actually was - and therefore a current BAF is always based on what the oil price was in the past, not the present.

“If you, for example, [a line] changed BAF on a monthly basis that would mean that you only know the January oil price in the beginning of February, and hence any change in BAF would take effect in the month of March.”

Source: lloydsloadinglist

Quality Companies