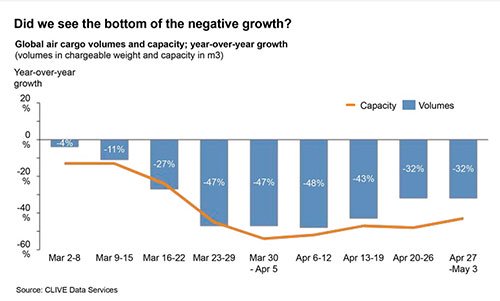

While air cargo volumes diminished rapidly in March, new data for April offers some hope that the decline may be ‘bottoming out’ in parallel with a possible stabilisation of the global economy.

According to the latest industry intelligence from CLIVE Data Services, in April air freight volumes declined 39%, year-on-year. The data specialist added that “an even greater capacity drop of 45% highlighted the current shortage of air cargo capacity”.

However, optimism could be found in its week-by-week data which revealed that air cargo volumes stabilised from mid-March to mid-April and became “less bad” during the two weeks to 3 May.

According to figures from CLIVE, global air cargo volumes were down, year-on-year, by 47% in the two weeks to 5 April, and 48% in the week to 12 April, before beginning to recover to a 43% deficit the following week and a deficit of 32% in the two weeks to 3 May.

That recovery of volumes broadly mirrored the pattern of capacity, which sank to a low of more than 50% below its 2019 level in the week to 5 April, according to figures from CLIVE, before gradually recovering.

CLIVE, which consolidates data shared by a representative group of international airlines, estimates that global air cargo capacity remained down, year-on-year, by as much as 40% in the week to 3 May.

The ‘preighter’ effect

Figures from Seabury Consulting indicated that capacity was down by a lesser amount of around 29%, year-on-year in the last two weeks of April – boosted by gradually increasing freighter capacity and a recovery in bellyhold capacity as more and more airlines introduced passenger aircraft as freighters – ‘passenger freighters’ or ‘preighters’ as some are now calling them.

The Seabury figures are based on international widebody passenger flights and are calculated based on regular cargo belly capacity, and so may underestimate the level of capacity recently re-added through airlines’ passenger freighter programmes – where the capacity has been increased in many cases by using the upper decks of passenger aircraft to also carry some cargo.

CLIVE noted that its latest air cargo market data “bears out the sentiment expressed by economists from Goldman Sachs and Morgan Stanley in reports on 4 May and 3 May respectively”, with Goldman Sachs stating that a number of the high-frequency indicators it tracks “suggest that the global economy is in the process of bottoming out”.

CLIVE’s ‘dynamic load factor’ for April of 67%, based on both the volume and weight perspectives of cargo flown and capacity available, shows an increase of 4 percentage points versus April 2019, reflecting pressure on capacity.

“Until very recently, many airlines would have bumped cargo without blinking an eye, to accommodate the luggage of their passengers. These same airlines are now removing seats from these same planes to create more space for cargo,” commented CLIVE’s managing director, Niall van de Wouw.

“The uniqueness of this situation is reflected in the new term ‘preighter’ in the air cargo vocabulary, coined by Lufthansa Cargo.

“April 2020 was also unique. With a decline of 39% in volumes versus April 2019, it must be one of the worst months in air cargo’s history. But a greater fall in capacity, mixed in with the urgent need for Personal Protective Equipment (PPE) materials by governments around the world, explains also why current air cargo yields have reportedly gone through the roof.”

He added: “Although it is too early to tell if we are seeing the very earliest signs of the road-to-recovery, the most recent trend, coupled with the views of leading global economists, might give us hope. Could it be that the worst is behind us?”

He acknowledged that “for all the cargo staff around the world that have been put on furlough and know that their temporary contract will not be extended”, or that have been made redundant as companies move to cut costs, “the word ‘recovery’ will be hard to swallow. Perhaps, more appropriately, April’s data is hopefully showing us that the situation is becoming ‘less worse’.”

Capacity crisis

Some air cargo observers have commented that air freight is currently suffering as much from a capacity crisis as a demand crisis, at least in some markets, with air freight volumes recovering in the second half of April thanks to the gradual increase in capacity.

Anecdotal reports highlight that there are significant volumes of cargo that shippers would like to transport by air if they could access capacity at an affordable price, rather than the current inflated price levels on certain lanes, with customers instead seeking alternative transport solutions including LCL sea freight, road or rail freight.

CLIVE’s Niall van de Wouw responded: “The main message we wanted to convey, which is in sync with the macro- reports from the banks, is that the air cargo industry is in a ‘less bad’ situation than a couple of weeks ago. Whether this is overall caused by a push in supply and or a push in demand, I would find difficult to answer.

“I would agree, however, that there is freight not being moved at the moment because the price is simply too high and/or there is no capacity. I have heard of perishable shippers in Africa which cannot get their produce to their European clients as the belly capacity is no longer there – while the potentially available freighters are rather deployed on more-profitable (for the airline) routes.”

As reported earlier this week overall outbound air cargo capacity from China was up 6% compared with 2019 levels in the last week of April, although air freight capacity from China remains highly constrained, as demand for shipments of Personal Protective Equipment (PPE) continues to boom.

In a 3 May COVID-19 operational update from freight forwarding and logistics group Agility, the forwarder noted that all mainland China export markets were “under tremendous pressure” as production resumes and passenger flight cancellations were sustained, despite the fact that total overall outbound air cargo capacity from China – maindeck plus belly cargo capacity, to all regions – had risen to pre-crisis levels, mainly through massive increases in freighter capacity deployed to serve the huge demand for capacity ex-China, and the corresponding very high freight rates.

Ocean-to-air conversions

Agility said a “trend of ocean-to-air conversions” was currently also exacerbating pressure on capacity outbound China, although “more freighters are entering the market”.

Agility also highlighted that Shanghai Pudong Airport (PVG) was reporting extremely heavy congestion on feeder roads, parking lots, and cargo terminals. Entry to terminal facilities can take 36 to 40 hours. Trucks are not allowed to unload outbound cargo until 48 hours prior to scheduled flight departure.

While for a second consecutive week, global air cargo capacity was 29% below levels for the same week in 2019, transpacific capacity was 4%-6% lower than 2019 levels, while transatlantic capacity was down more than 50% from year-prior capacity levels, the update noted, quoting data from Seabury.

Global widebody belly capacity had increased 23% compared with the previous week, largely as a result of passenger aircraft being converted into all-cargo mode; but it remains 78% below 2019 levels.

Freighter (+20%) and express freighter (up +16%) capacity were up versus 2019, but not enough to compensate for the belly space that has been taken out of the market, Agility added.

Anecdotal reports from airlines indicate that they are continuing to add ‘passenger freighter’ capacity, with some now beginning to operate significant capacity through these new programmes. For example, as reported today, the world’s largest international air cargo carrier, Emirates, is back operating close to 100 daily cargo flights as it rebuilds its global cargo network following the shutdown of most of its passenger flights. Alongside 11 Boeing 777 freighter aircraft, it is now also operating around 60 of its Boeing 777-300ER passenger aircraft as dedicated cargo aircraft, expanding its scheduled cargo network to 67 cities across six continents.

In April, Emirates SkyCargo operated over 2,500 dedicated cargo flights, with more than 850 flights on its freighters and 1,650 flights on its ‘passenger freighters’ to over 80 destinations, on scheduled and special charter services.

Nabil Sultan, Emirates’ divisional senior vice president for cargo, said the carrier “will be operating more flights over the coming weeks with cargo in both the belly as well as inside the main cabin. In addition, we are also looking at other measures including the removal of seats from select aircraft to deploy on high demand trade lanes.”

Forwarder capacity programmes

Alongside increases in scheduled airline cargo capacity, in the form of freighters and passenger aircraft operating on a cargo-only basis, a number of freight forwarders have also set up their own programmes.

Bolloré Logistics has extended its programme of freighter charter flights between Europe and China into May as a part of its ‘coronavirus impact’ contingency plans. It is offering customers air charter solutions on around 30 flights this month, originating in Shanghai, Zhengzhou and Guangzhou and bound for Luxembourg, Paris Roissy-Charles de Gaulle, Liège and Frankfurt Hahn. The flights are operated Cargolux, Qatar Airways Cargo, Silk Way West Airlines and CAL Cargo Airlines.

Bolloré is also offering customers Europe-China air charter solutions with Silk Way West Airlines operating a schedule of four flights in May between Luxembourg and Shanghai.

Last week, DB Schenker announced it had set up ‘The China Shuttle’, a daily air cargo connection between Shanghai and Munich, using three Boeing 767 passenger aircraft from Icelandair converted into all-cargo mode, in response to strong demand for PPE. Initially, 45 flights are planned this month and further connections, for example, twice a week to Chicago, are also in preparation, the company said.

Meanwhile, in its latest COVID-19 update, Kuehne + Nagel said the continuing global demand for PPE out of China has further increased the pressure on freighter capacity. It highlighted congestion up to four days across various airports in Greater China.

Agility’s update also highlighted an “unprecedented” rate surge on intra-Asian lanes due to a “massive” capacity reduction resulting from passenger flight and freighter cancellations which in turn is “constraining the long-haul export capacity to both Europe and the US. It said the export market from Hong Kong to Europe and US is “picking up gradually” with a “sharp” increase in rates.

Source: lloydsloadinglist

Quality Companies