Intra-Asia air freight prices have surged to record levels in the last two weeks as factories in Asia resume production and restock with supplies of components, in what some believe could be a lead indicator for what may happen in the next few weeks for intercontinental volumes from China, once production ramps up more fully again.

One major global cargo charter and freighter operator has reported intra-Asia charter prices soaring to US$500,000-$600,000, a figure that would normally be reserved for a round-trip transpacific charter flight, with one of the airline’s senior executives noting that these charter rates had never been seen before on intra-Asia routes.

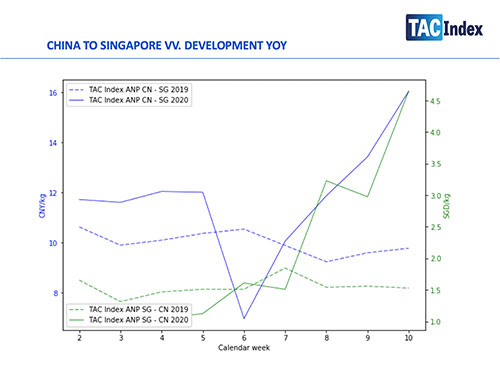

This surge in intra-Asia air freight prices is reflected in the latest figures from TAC Index – although those figures from TAC are a blend of spot rates and contract rates and pricing from the scheduled and charter capacity, and hence less extreme than the price rises seen for charter services alone.

According to TAC index, prices from Korea to China began rising in week eight, before shooting up rapidly in week nine to almost double the price level of the previous week.

Prices from Singapore to China have also been rising rapidly since week seven, from a level of around 1.5 Singapore dollars (S$1.5) per kilo to more than S$4.5 per kilo at the end of last week.

And after plummeting in week five from S$3 per kilo in week 5 to just over S$1per kilo in week six, prices from China to Singapore have also risen sharply to more than for S$4.5 per kilo at the end of last week.

John Peyton Burnett, MD of TAC index, told Lloyd’s Loading List that while these figures are interesting in themselves, cargo charter operators are keen to know whether it is likely to signify a build-up of production that will transform in the coming weeks to strong demand for intercontinental capacity, as is expected.

“I had a carrier asking us to run some bespoke charts for intra-Asia,” he noted. “The carrier in question was speculating that this was a result of semi-conductor companies ramping up production. This could be a lead indicator for what might happen next inbound/outbound from China once their production ramps up again.

“The carrier in question reviewed the charts and concurred that this is what they are seeing on the market.”

The observations also broadly reflect those from some freight forwarders. As reported yesterday, in a ‘coronavirus’ operational update this week, global freight forwarding and logistics group Agility highlighted that as production picks up in China, outbound air freight capacity is already “very tight” and inbound capacity “severely constrained”.

It noted that one feature of the current China market is the increasing number of ocean-to-air conversions, which is exacerbating pressure on capacity, as is strong demand for full and part charters, driving up charter rates. While the Hong Kong market is comparatively stable, it said intra-Asia lanes are experiencing heavy congestion. It said intra-Asia trade lanes were significantly impacted by the cancellations of passenger air services within the region, with wide-body belly capacity down 59%. It said rates on intra-Asia lanes are “extremely high and volatile”.

On the air freight side more broadly to and from China, Agility noted that airports were currently operating smoothly without any major backlogs, despite restricted road access at some locations.

Agility underlined that China “continues to experience significant capacity reductions.” Quoting Seabury, it said that available cargo capacity from China was down 39% versus last year. Flight cancellations on China routes have removed 5,200 tonnes per day of capacity, with belly capacity on China routes down 85% and maindeck capacity by 12%.

Inbound capacity has been “severely constrained” and led to upward pressure on rates, while outbound air freight capacity, especially from Shanghai Pudong (PVG), is “very tight”, Agility said.

Long-haul export capacity to both Europe and the US is “available but constrained and rates are increasing rapidly”.

It also notes that inbound ocean capacity remains under pressure too due to outbound blanked sailings during and after the Chinese New Year period. However, the squeeze on China’s domestic trucking network is easing as drivers are resuming duty and road restrictions and closures are lifted.

According to the update, work has largely resumed across China, with production estimated at 60-70% of normal. However, large manufacturing clusters still remain at only 50-60% of production capacity.

It added that quarantine and restrictions remain in place for anyone returning from Hubei Province, the epicentre of the epidemic, and full production was expected no earlier than the middle of March.

Source:lloydsloadinglist

The opinions expressed herein are the author's and not necessarily those of The OLO News.

Quality Companies