Air freight volumes transported collapsed in the final week of March, falling by almost 50%, amid massive cuts in global bellyhold cargo capacity and lockdowns in large parts of the world.

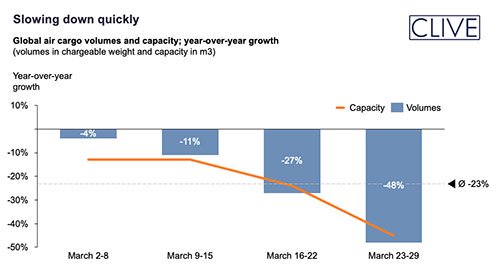

Overall air cargo volumes transported in March fell by 23% versus the same four weeks of 2019, but the decline in demand accelerated week upon week throughout the month, according to the latest air cargo market intelligence from Clive Data Services. In the week ending 29 March, volumes were just over half of what was moved in the same seven days of last year – down 48%, year on year.

The collapse in traffic volumes at the end of March followed relatively respectable volumes in the first week of the month, when chargeable weight was down just 4% – despite an overall reduction in capacity of around 12%, year on year – as volumes began to recover following the reopening of some capacity to and from China. But as the month progressed, air freight chargeable weight continued to fall in parallel with declines in overall global air freight capacity, with tonnages down 11%, year on year, in the second week of March and down 27% in the third week of the month – before the near precipitous decline in the final week, a week in which capacity was also down by more than 40%, year on year.

Reflecting this parallel drop in both capacity and tonnages, the ‘dynamic load factor’ for the four-week period of 68% – based on both the volume and weight perspectives of cargo flown and capacity available – represented a decrease of 1.5% points versus 2019, but an increase of 3% points versus February.

Clive’s managing director, Niall van de Wouw, confirmed to Lloyd’s Loading List that the company’s analyses covers all the flights operated by its participating airlines, includes charters, as well as the passenger aircraft as cargo-only flights that many airlines recently began operating to partially replace the air freight capacity lost due to the cuts in passenger air services. “The decline is indeed extraordinary, but these are extraordinary times,” he told Lloyd’s Loading List.

Hong Kong-Europe recovery

Van de Wouw added: “Sadly, there is no getting away from the overall concerning developments we are seeing in the global air cargo market, but there is perhaps a little bit of hope to be found in Asia – which was hit first by the outbreak of COVID-19. In previous data, we reported the step-by-step improvement on the Hong Kong to Europe market, and this is continuing. The reported volumes for the last week of March 2020 were 26% higher than before the Chinese New Year started. If this is sustained, it will at least offer some hope for the rest of the industry of the speed with which air cargo traffic can recover after a very difficult time.”

Again reflecting this parallel drop in both capacity and tonnages at the end of last month, international air freight forwarders continue to report tight capacity in many key markets. In an update yesterday, Kuehne + Nagel (KN) noted that “with the majority of carriers closing down or making large cuts in their passenger networks, we see acute shortage of lift at a time of strong demand on all trade lanes. In order to compensate for belly capacity shortages, freighter capacity has significantly increased; however, at the moment, this increase is not sufficient to offset a strong drop in global belly capacity.”

The forwarder said it was working closely with its long-term carrier partners to have full transparency of the situation to address the needs and requirements of its customers, but noted. “At this point in time, we can no longer assure lead times at their applicable rates. To the extent available, charter space will be offered at current market rates

Some air freight observers believe that the decline in volumes transported at the end of March reflected not so much a decline in demand, but of air freight customers being unwilling to pay the much higher prices required to get their cargo flown in the new freighter-dominated and charter-dominated capacity environment, which is consistent with reports of some forwarders slowing down their service because of the higher prices of guaranteed air freight capacity. This also appears consistent with an analysis this week by Clive indicating that the load factor across the Atlantic had increased substantially in the last three weeks of March, because capacity fell quicker than demand.

Peter Stallion, aviation and freight derivatives specialist at market specialist Freight Investor Services (FIS), said the key factor for prices at the moment was the fact that the increases in freighter capacity was not sufficient to offset the strong drop in global belly capacity. He added: “The potential market-shifting news is the verbal support from the Chinese government to support capacity ex-China. Beijing does this with container freight with regard to new container ships, and its often blamed for suppression of longer-term container freight prices. I would not be surprised if they will attempt the same with air freight, through purchases and leases arranged through investment banks.”

Regional perspective

Commenting on the individual regions, KN noted that for North America, the majority of airlines had announced “a drastic reduction of passenger flights offering limited capacity at market rates” in the second half of March, adding: “Since the trade lane between Europe and North America is largely dominated by passenger aircraft, we have been experiencing a severe drop in the available capacity. In reaction to evolving capacity constraints due to severe cuts in belly capacity, we see an increase in freighter capacity compared to last week.”

The picture for Europe was similar, with KN noting: “With the majority of flag carriers closing down their passenger networks, we experience significant capacity constraints to all major markets. Increased congestion at airports and cargo rerouting via European hubs are affecting overall processing time and transit times of shipments. Overall, freighters are back on schedule and carriers offer additional charters on congested lanes such as Europe to the US.”

On Asia, KN said the overall situation with regard to the operational status of airports, truckers and customs clearance in China had returned to normal levels, with only Wuhan airport remaining closed to commercial traffic. It said the recovery of production in China was “leading to an emerging transportation demand, adding pressure on available air freight capacity. In addition, with effect from March 29, China has further reduced the number of international passenger flights as part of its COVID-19 prevention and control measures.”

KN also reported pressure on capacity caused by limited passenger flight activity “in the majority of South Asia Pacific countries”, noting: “Complete lockdown in India has a direct impact on customs and terminal operations, trucking, and available capacity. In addition to all international passenger flights being suspended until April 14, we see that freighter capacity out of India is also reducing.”

Clive’s “first-to-market” analyses consolidates data shared by a representative group of international airlines operating to all regions of the world. Based on both the volume and weight perspectives of the cargo flown and capacity available, “it gives the air cargo industry the earliest possible barometer of market performance each month”, Clive claims.

The company’s ‘dynamic load factor’ analysis aims to reflect the fact that airlines’ cargo capacity nearly always ‘cubes out’ before it ‘weighs out’ as a result of an aircraft’s higher capacity density .

Source:loydsloadinglist

The opinions expressed herein are the author's and not necessarily those of The OLO News.

Quality Companies